Using a Mortgage Calculator

By

ASB April 09, 2021 | 5 min read PersonalAre you thinking of buying a home in Hawaii? Whether you’re a first time home buyer or are seeking to downsize in retirement, estimating your mortgage payments can help you budget for the cost of a new home.

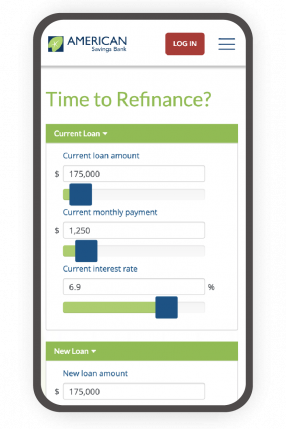

Our helpful ASB mortgage calculators help you estimate your monthly mortgage payments based on your expected interest and terms. You’ll be able to start budgeting for your new home and get a better idea of how much you can afford.

How are mortgages calculated?

Your lender uses the agreed-upon terms of your loan to determine just how much you’ll pay each month. A mortgage calculator helps you better understand your payments by processing the formula automatically. The mortgage payment formula is:

M = P[r(1+r)^n/((1+r)^n)-1)]

It may look complicated, but we’re here to help you break it down. Each value in the formula represents a different part of your mortgage payment:

-

M: Your monthly mortgage payment.

-

P: The principal loan amount (the original amount of money you’re borrowing).

-

r: Your interest rate on the loan. Most lenders provide an annual interest rate. To get an accurate monthly payment amount, you’ll need to divide your annual interest rate by 12 months. For example, if your annual rate is 6%, your monthly rate will be 0.005 (0.06/12 = 0.005).

-

n: The number of payments you’ll make over the full term of the loan. Be sure to multiply the number of years in your term by 12 to get an accurate number of payments over 12 months. A 30-year loan, for example, has 360 payments (12 months X 30 years).

Our mortgage calculators does the work of processing the numbers in the formula for you. It also reduces the chance of errors when estimating your monthly payment.

Why use a mortgage calculator?

Mortgage calculators are great to see if you can afford the monthly payment for potential mortgage terms. That’s not the only reason to use a mortgage calculator, though. You might want to use a calculator to:

-

See What You Can Afford: Mortgage calculators let you play around with different loan amounts, which is perfect if you’re looking to find out how much you can afford. Simply look up a few homes for sale in the area you want to buy to get an idea of the current asking prices. Use the calculator to change the loan amount based on different houses you might be interested in. If the monthly payment is too high for your budget, try to find a more affordable home. Keep repeating the process until you find a monthly mortgage payment that’s right for your budget.

-

Estimate Your Monthly Payment: Do you have a home you’re ready to purchase? Use the calculator to estimate your monthly mortgage payment before committing to your home loan. Use the interest rate you expect to receive from ASB and decide on your term length. Subtract your expected down payment from the home’s asking price to get your principal loan amount. The calculator will show you what you can expect to pay each month.

-

Explore Term Lengths: The length of your home loan can make a big difference in your monthly payments. A shorter loan will generally have higher monthly payments than one that’s stretched over a long period of time. Use our calculator to change the term length of your potential mortgage and see if a longer or shorter term is best for your financial situation.

-

Plan for an Early Payoff: Are you putting extra money toward your mortgage each month? A surprising use for our mortgage calculator is to plan for an early loan payoff. Use the “prepayments” section of the calculator to add monthly, yearly, or one-time payments to your loan calculation. The calculator will provide your interest savings based on the extra payment.

Get ready to buy a home

Buying a home is likely one of the biggest financial decisions you’ll ever make. Be prepared to start your home search by researching how much you can afford each month. Use our convenient mortgage calculators to get started today.