A savings account is a type of bank account that safely stores your money and earns you interest.

To open a savings account, you will need to provide acceptable forms of identification such as a Driver’s License, State ID, or Passport.

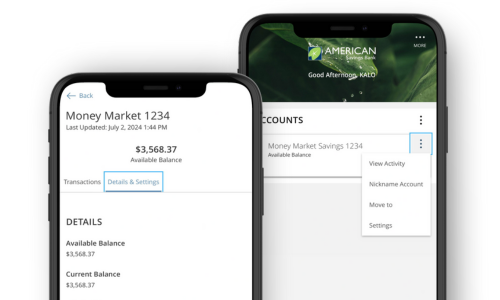

Both a Money Market Savings account and Tiered SavingsSM account pay higher interest for higher balances. The difference between the accounts is the Money Market account provides the ability to write checks and the Tiered Savings does not.

To compare savings accounts, click here.

Interest is compounded daily and credited to your account monthly. If your account is closed or is transferred to a non-interest bearing account before interest is credited, you will not receive the accrued interest. If the interest amount calculated for the monthly cycle is less than half a cent, interest will not be paid.

The interest rate and annual percentage yield ("APY") on your account are shown in the separate Customer APY and Interest Rate Sheet ("Rate Sheet"). Your interest rate and APY may change. At our discretion, we may change the interest rate on your account at any time. An APY is an annualized rate that allows you to compare rates across deposit products. View the rates.

A checking account is considered dormant at 12 months of inactivity, and a savings account is considered dormant at 36 months of inactivity. While your account is dormant, you will receive account statements but will not be able to access the ATM or use your debit card at point-of-sale (POS) terminals.