ASB Stories

-

Community

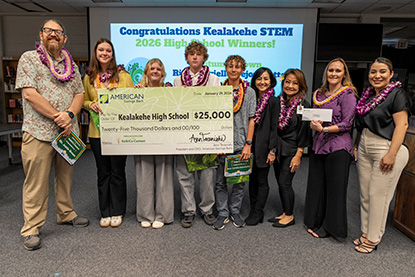

ASB Awards $135,000 to Seven Local Public Schools and Strengthens Financial Literacy for Hawaii’s Future Leaders

American Savings Bank (ASB) awarded $135,000 to nine winning student teams from seven public schools through its annual Bank for Education KeikiCo Bus...

-

News Releases

American Savings Bank CEO Ann Teranishi Appointed to Federal Reserve Bank of San Francisco’s Community Depository Institutions Advisory Council

American Savings Bank President and Chief Executive Officer Ann Teranishi has been appointed to the Federal Reserve Bank of San Francisco’s Communit...

-

Personal

3 Tips for Buying Your Dream Home in Hawaii

Are you dreaming of owning a home in Hawaii? We’re here to help. At American Savings Bank (ASB), we’re committed to helping you achieve your homeowner...

-

News Releases

ASB's 2025 Workplace Giving Program Contributes $277,000 to Four Local Nonprofits

American Savings Bank (ASB) announced the results of its 2025 Kahiau Giving Campaign, contributing more than $277,000 to four local nonprofits. This y...

-

News Releases

ASB's Hui Kapili Accelerator Receives National Recognition for Tackling Affordable Housing Challenges and Driving Economic Growth

American Savings Bank has received national recognition from the American Bankers Association (ABA) Foundation for its Hui Kapili Accelerator, earning...

-

Personal

Avoid Check Fraud with #PracticeSafeChecks Tips and Tools

It should come as easily as fastening your seat belt on a plane, so buckle up for this one. Despite the fact that check use has declined by 25%, repor...

-

Personal

Avoid Bank Scams with #BanksNeverAskThat Tips and Tools

At American Savings Bank (ASB), we’re committed to making banking easy and safe for our customers. With October being National Cybersecurity Awareness...

-

Personal

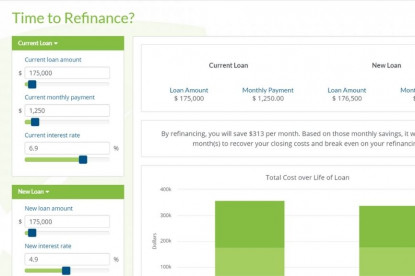

What is a Home Equity Line of Credit (HELOC) vs. Refinancing?

Owning a home is a significant accomplishment for many of us in Hawaii. In addition to that special place where precious memories are made, you can al...

-

Personal

ASB Opens Applications for 2025 KeikiCo Business Plan Competition

American Savings Bank (ASB) is now accepting applications for its 2025 KeikiCo Business Plan Competition, a statewide challenge that invites Hawaii pu...

-

Personal

American Savings Bank Named One of the Best Banks in Hawaii by Forbes for the Sixth Year

American Savings Bank (ASB) has once again been recognized as one of the Best In-State Banks in Hawaii by Forbes – marking six years of this prestigio...

-

Personal

Moving to Hawaii? 5 Tips for Purchasing a Property in Hawaii

Hawaii draws new residents from across the country and around the world with its warm beaches, rich and historic culture, and sun-soaked weather. Howe...

-

News Releases

ASB Appoints John Jacobi as Executive Vice President and Chief Information Officer

American Savings Bank (ASB) has named John Jacobi as Executive Vice President and Chief Information Officer (CIO). John will oversee ASB’s technolog...

-

News Releases

ASB and Federal Home Loan Bank of Des Moines Award $625,000 to Six Hawaii Nonprofits to Advance Affordable Housing and Community Resilience

Funding will support programs for Lahaina homeowner recovery, affordable housing, financial education and Aala Park revitalizationAmerican Savings Ba...

-

News Releases

ASB Celebrates Grand Opening of New Lahaina Branch

Fifth Maui location and $10,000 donation to Maui Economic Opportunity demonstrate ASB’s commitment to serving and uplifting Valley Isle communitiesAme...

-

News Releases

Business Leaders Come Together to Equip 12 Local Construction Companies With the Tools Needed to Succeed in Hawaii’s Competitive Market

Experts Say Capacity-Building is Key to Addressing Some of State’s Most Pressing Challengesaio and American Savings Bank (ASB) are pleased to announce...

-

News Releases

ASB Announces 10 Local Nonprofit Winners of $100,000 Community-Driven Competition

Over 24,000 votes cast in support of 30 finalistsAmerican Savings Bank (ASB) is proud to announce the 10 winners of the ASB Charitable Foundation’s $1...

-

News Releases

ASB Celebrates 100 Years of Serving Hawaii with $100,000 Donation to Local Nonprofits

Community invited to vote for organizations to receive funding through March 11To celebrate 100 years of serving Hawaii, American Savings Bank (ASB) i...

-

News Releases

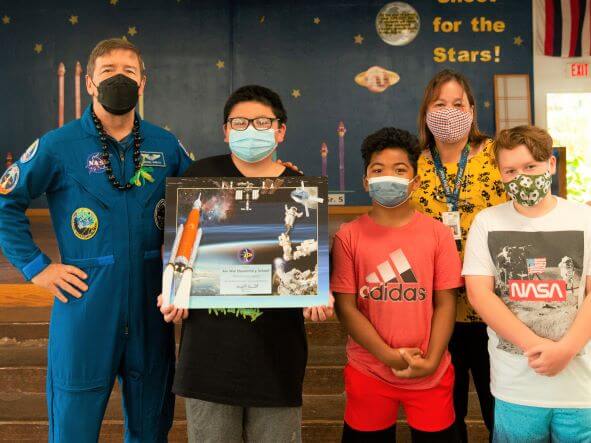

ASB Awards $135,000 to Aspiring Keiki Entrepreneurs

Annual KeikiCo Business Plan Competition is inspiring and developing the next generation of local business leadersAmerican Savings Bank (ASB) awarde...

-

News Releases

Building a Stronger Hawaii: Hui Kapili Business Accelerator Announces Applications for Second Cohort Following Successful First-Year

aio and American Savings Bank (ASB) are pleased to announce the start of the second cohort for the Hui Kapili Accelerator, following incredible succes...

-

News Releases

ASB Celebrates 100 Years of Serving Hawaii’s Residents, Businesses and Communities

Centennial celebration kicks off with announcement of new ASB Charitable Foundation’s $100,000 pledge to local nonprofits.American Savings Bank (ASB...

-

News Releases

American Savings Bank Welcomes New Investors

Bank will continue to operate independently and serve Hawaii’s residents and businesses; no impact to customers, employees or branches.American Saving...

-

Personal

Stay Safe This Holiday Season: Tips to Avoid Common Holiday Scams

Information below is provided by the Hawaii Bankers AssociationThe holiday season is a time for giving, celebration, and togetherness – but unfortunat...

-

Community

ASB Holiday Skateboard Event Inspires Future Skaters at Aala Park

American Savings Bank, Super Skate Posse, APB Skateshop and Trust for Public Land team up with homegrown professional skateboarder Jaime Reyes to brin...

-

News Releases

American Savings Bank Reports Third Quarter 2024 Financial Results

Net interest margin expanded to 2.82%, up 3 basis points from the prior quarterContinued strong credit quality and capital positionAmerican Savings Ba...

-

Community

ASB Leads Annual Statewide Volunteer Effort for National Cleanup Day

ASB teammates volunteer across five islands to clean and restore Hawaii’s communities and natural environments.Nearly 200 American Savings Bank (ASB...

-

News Releases

Building a Stronger Hawaii: Hui Kapili Business Accelerator Builds Capacity for Local Construction Industry

Sixteen leaders from 10 businesses selected to receive free training, resources and mentorship from industry leaders to elevate their business and the...

-

News Releases

American Savings Bank Pledges $50,000 to Support Rainbow Wahine Student-Athletes

The University of Hawai‘i Athletics Department, in partnership with the University of Hawai‘i Foundation, is proud to announce a new collaboration wit...

-

Business

Why Every Business Owner Needs a Business Checking Account

Are you starting up a new business? We’re here to help! One of the ways we help businesses manage their finances is by offering different types of bus...

-

News Releases

American Savings Bank Reports Second Quarter 2024 Financial Results

2Q 2024 net loss of $45.8 million reflects after-tax goodwill impairment of $66.1 million in connection with HEI’s ongoing review of strategic options...

-

News Releases

American Savings Bank Opens Applications for 2024 KeikiCo Business Plan Contest

American Savings Bank (ASB) is excited to announce the return of its seventh annual Bank for Education KeikiCo Contest, a business plan competition de...

-

Personal

Checking vs. Savings Accounts: Differences Explained

Two of the most popular types of bank accounts are checking and savings accounts come with features that can benefit your financial health. Unsure wha...

-

Personal

American Savings Bank Named Hawaii's Best In-State Bank for Fifth Year by Forbes

American Savings Bank (ASB) has been named to America’s Best In-State Banks Forbes Magazine's list of America’s Best In-State Banks 2024 for the fifth...

-

News Releases

ASB and Hawaii Home + Remodeling Launch New Accelerator for Hawaii’s Construction and Building Entrepreneurs

In the midst of a statewide labor shortage coupled with outward migration and a shrinking population due to Hawaii’s high cost of living, Hawaii’s con...

-

News Releases

ASB Donates $443,000 Through Annual Workplace Giving Campaign

American Savings Bank (ASB) is proud to announce that its 2024 Kahiau Giving Campaign has raised $443,000. The charitable contribution will support fi...

-

News Releases

American Savings Bank Reports First Quarter 2024 Financial Results

1Q 2024 Net Income of $20.9 million, an increase of 12.8% from 1Q 2023Strategic Balance Sheet Repositioning Executed in the Fourth Quarter of 2023 Con...

-

News Releases

ASB and Federal Home Loan Bank of Des Moines Award $850,000 to Six Hawaii Nonprofits

American Savings Bank (ASB) and the Federal Home Loan Bank of Des Moines (FHLB Des Moines) are pleased to award $850,000 to six local nonprofits throu...

-

Community

ASB Reaffirms Its Commitment to the Community With Highest Annual Charitable Giving Amount in Company History

Despite another challenging year for the banking industry, American Savings Bank (ASB) exceeded its 2023 annual charitable giving goals, driven partly...

-

News Releases

Brad Mattocks Joins ASB as Executive Vice President and Chief Information Officer

American Savings Bank (ASB) has hired Brad Mattocks as its Executive Vice President and Chief Information Officer (CIO), following the planned retirem...

-

News Releases

American Savings Bank Reports Fourth Quarter and Full Year 2023 Financial Results

Full Year Net Income of $53.4 Million2023 Results Include an $11.0 Million After-tax Loss Resulting from a Fourth Quarter Balance Sheet Repositionin...

-

Personal

Banking Basics for Teens

PICTURE THIS: You’re about to start a summer job and your boss asks you for your bank information so you can deposit your paycheck right into your ban...

-

Other

The 411 on the Earned Income Tax Credit (EITC)

Note: This post shares information relevant to tax filers. Consult your tax advisor for information regarding your individual situation.Have you heard...

-

News Releases

Tony Mizuno Promoted to Executive Vice President of Commercial Banking Following Gabe Lee's Retirement After 25 Years at ASB

American Savings Bank (ASB) announced the retirement of Gabe Lee, who served as Executive Vice President (EVP) of Commercial Banking for over 25 years...

-

Community

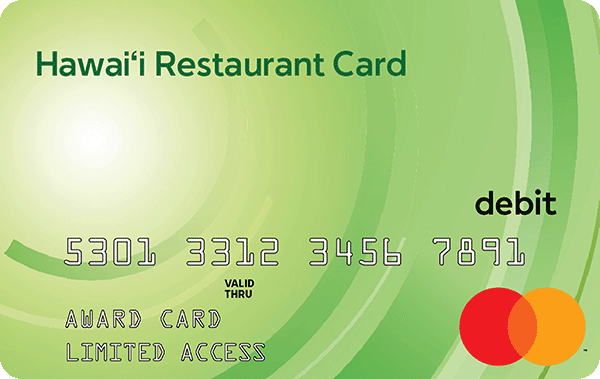

Guy Fieri Foundation Donates $1.2 Million to Lahaina Restaurant Workers Impacted by Wildfires

With a deep love for Maui, celebrated chef and TV personality Guy Fieri teamed up with the Hawaii Restaurant Association (HRA), American Savings Ban...

-

Community

ASB Awards Over $145,000 to Winners of KeikiCo Business Plan Competition

Student entrepreneurs across the state presented their best ideas in American Savings Bank’s 6th annual Bank for Education KeikiCo Business Plan Compe...

-

Community

Keiki Super Skaters Fly High at Aala Park

On Sunday, Dec. 3, American Savings Bank (ASB), Super Skate Posse, APB Skateshop and Trust for Public Land join forces at Aala Park for a sneaker, hel...

-

News Releases

American Savings Bank Reports Third Quarter 2023 Financial Results

$8.6 Million of Maui Wildfire-Related Expenses, Including $5.9 Million of Additional Provision. Solid Credit Quality and Capital Position. Liquidity R...

-

Personal

What is a Home Equity Line of Credit (HELOC), and is it Right for Me?

A HELOC is a line of credit that allows homeowners to borrow against the equity in their home. A HELOC is like a credit card, giving you the flex...

-

Community

ASB's Annual Statewide Volunteer Day on Five Islands Makes a Significant Impact on National Make a Difference Day

American Savings Bank (ASB) brought together hundreds of teammates, friends and family members across five islands on Saturday, Oct. 28, in honor of N...

-

Personal

American Savings Bank Receives Exceptional Community Bank Service Award

Content written by Independent BankerThere’s a word in Hawaiian—kahiau—that means to give generously without expecting anything in return, and America...

-

News Releases

American Savings Bank Reaffirms Strong Capital Position, Excellent Credit Quality and Ample Liquidity in Aftermath of Maui Wildfires

American Savings Bank (ASB), is well positioned and stands ready to support the community as families heal and rebuild in the aftermath of the Maui wi...

-

News Releases

Hawaii Bankers Association Member Banks Accepting Monetary Donations to Support Maui Relief Efforts

The Hawaii Bankers Association (HBA) announced today it launched Aloha for Maui, a program accepting donations at any of its member branches statewide...

-

News Releases

American Savings Bank Pledges $100,000 to Wildfire Relief Efforts

American Savings Bank (ASB) committed to donate $100,000 to nonprofits, including the American Red Cross, to provide assistance to local residents and...

-

News Releases

American Savings Bank Opens Registration for 2023 Bank for Education KeikiCo Contest

American Savings Bank (ASB) is excited to announce the return of its Bank for Education KeikiCo Contest, an annual business plan competition that empo...

-

News Releases

ASB Launches “This is HOME” First Time Home Buyer Program to Address Growing Housing Crisis

American Savings Bank (ASB) is proud to introduce “This is HOME,” a new first-of-its-kind affordable financing solution for first time home buyers des...

-

Personal

American Savings Bank Named Best Bank by HONOLULU Magazine

American Savings Bank (ASB) was recently voted a Best Bank in HONOLULU Magazine’s “Best of HONOLULU” list.The annual “Best of HONOLULU” award list cel...

-

News Releases

ASB and Federal Home Loan Bank of Des Moines Award $1.8M to Local Nonprofits

American Savings Bank (ASB) and the Federal Home Loan Bank of Des Moines (FHLB Des Moines) are proud to announce the award of $1.8 million to eight lo...

-

News Releases

American Savings Bank Named Hawaii’s #1 Best Bank in Forbes 2023 List

American Savings Bank (ASB) has been recognized as the only bank in Hawaii named on Forbes’ America’s Best-In-State Banks 2023 list. This prestigiou...

-

Personal

Buying a Condo in Hawaii: What to Think About When Purchasing Your Vacation Home

Sparkling blue water, soft sand beaches, and exciting local culture make Hawaii a go-to destination for vacationers from around the world. Maybe you’v...

-

News Releases

ASB and Fiserv Award $10,000 to Local Business in Molokai

American Savings Bank (ASB), in collaboration with Fiserv, Inc., is proud to announce the recipient of a $10,000 grant as part of the Fiserv Back2Busi...

-

News Releases

ASB Invests More Than $4.3 Million in Hawaii Community Lending

American Savings Bank (ASB), in collaboration with Hawaii Community Lending (HCL), announced the bank’s $4.3 million investment in homeownership oppor...

-

News Releases

ASB Donates More Than $368,000 to Support Local Nonprofits Addressing Critical Community Needs

American Savings Bank (ASB) is proud to announce that its 2023 Kahiau Giving Campaign has raised $368,268, which will enable local organizations to co...

-

News Releases

ASB Hosts Seeds of Service Community Clean-Up

American Savings Bank (ASB) partnered with more than 20 organizations to bring real impact to the community through its Seeds of Service Community Cle...

-

Personal

ASB Named Best Place to Work in Hawaii for 2023

American Savings Bank (ASB) has been named a Hawaii Business Magazine Best Place to Work for 2023, now totaling 14 consecutive years of ASB receivin...

-

Personal

What is a Certificate of Deposit and What Are its Pros and Cons?

Savings accounts aren’t the only option you have when saving for the future. A Certificate of Deposit (CD) can also help you reach your goals. CDs com...

-

Personal

Emi Au Named 2023 Women Who Mean Business Honoree

Emi Au, Senior Vice President, Director of Consumer Banking Strategy and Planning, was recently named a Pacific Business News (PBN) Women Who Mean...

-

Personal

Jumbo Loan Options: What to Know About Terms and Rates

In Honolulu County, as in many neighborhoods throughout the islands, more than half of the single-family homes hover near a million. If your family is...

-

News Releases

ASB Introduces New Mortgage Options to Expand Affordable Homeownership Access for Native Hawaiians

American Savings Bank (ASB) is now approved by the U.S. Department of Housing and Urban Development (HUD) to provide HUD 184A and FHA 247 loans to the...

-

News Releases

ASB Releases First Environmental, Social and Governance (ESG) Report

American Savings Bank (ASB) released its first annual Environmental, Social and Governance (ESG) report, which highlights ASB’s ongoing efforts to sup...

-

Personal

5 Things to Know About Jumbo Loans

In home loan land, there are two big categories (aside from government loans): conforming loans and portfolio loans. There’s much more on that topic...

-

Personal

3 Mortgage Tips for Homeownership

At American Savings Bank (ASB), we’re committed to helping you achieve your dream of homeownership in Hawaii, whether you’re a first-time homebuyer or...

-

Personal

Paying a Mortgage vs. Paying Rent: What's the Difference?

You’re sitting at the kitchen table with another cup of coffee in the nighttime glow of your laptop. You’ve got a blank spreadsheet on your desktop, h...

-

News Releases

American Savings Bank Announces 2022 Community Impact Contributions

American Savings Bank (ASB) announced its charitable contributions for the 2022 calendar year. In total, ASB donated more than $1.4 million to the com...

-

Community

ASB Awards $140,000 to Winners of 2022 Bank for Education KeikiCo Business Plan Competition

American Savings Bank (ASB) announced the winners of its 2022 Bank for Education KeikiCo Business Plan Competition. Nearly 400 students grades 3 to 12...

-

Community

American Savings Bank Celebrates Newly Renovated Hilo Branch

American Savings Bank (ASB) celebrated the completion of its Hilo branch renovation project at a private blessing ceremony on Monday, Nov. 21. The con...

-

News Releases

ASB Distributes Thanksgiving Pies to 1,100 Teammates Across the State at “Pumpkin Pie Drive By”

American Savings Bank (ASB) hosted a statewide Thanksgiving drive-thru for its 1,100 teammates across the state on Sunday, Nov. 20, as part of its ann...

-

Personal

How to Start Saving Money for a House

When you spend your leisure time flipping through Zillow® and scrolling around decor inspo on Instagram, it can seem like actually saving up enough mo...

-

Personal

What Are Mortgage Points?

Mortgage points are one of the most often-referenced (and most confusing) parts of the mortgage conversation. Mark James, vice president and execut...

-

Personal

Student Loan Credit Pre-Qualification

Resources and content provided by College Ave Student Loans “Will I be approved? What rates can I expect?” These thoughts have probably run through...

-

Personal

Tips on Taking Out Private Loans for College

Resources and content provided by College Ave Student Loans If you’re planning on going to college, you might need to take out private student loan...

-

Personal

What is a Private Student Loan Cosigner? And Why Do I Need One?

Resources and content provided by College Ave Student Loans When it comes to the total cost of college, a private student loan can help fill i...

-

Personal

Banking is Easy and Convenient with ASB’s ATMs

At American Savings Bank (ASB), we’re always looking for ways to make banking easy and convenient for customers. Valerie Wada, branch manager at the K...

-

Personal

ASB Teammates Volunteer Across the State on National Make a Difference Day

American Savings Bank (ASB) teammates on four islands came together on Saturday, Oct. 22, which is National Make a Difference Day, to bring real impac...

-

News Releases

ASB Donates $129,000 of Unused Hawaiʻi Restaurant Card Business Holiday Card Funds to Three Local Nonprofits

American Savings Bank (ASB) announced it is donating $129,000 in unused funds from the Hawaiʻi Restaurant Card (HRC) Business Holiday Card program. Th...

-

News Releases

ASB Supports Honolulu Little League World Series Champions with $12,000 Donation and a Two-Day Celebration

American Savings Bank (ASB) proudly supported the Honolulu Little League World Series (HLLWS) team in their quest to become this year’s Little Leagu...

-

Personal

5 Ways to Protect Your Money During Inflation

You may not be able to control rising gas prices or the volatility of the stock market, but now is the perfect time to take control of your finances s...

-

Personal

How to Buy a Home Despite High Interest Rates

Don’t let rising interest rates and an uncertain market environment deter you from making your homeownership dreams a reality. Michelle Luxton, vice p...

-

Personal

What Is a Parent Loan?

Resources and content provided by College Ave Student Loans A parent loan is money a student’s parent or guardian borrows to help pay for...

-

Personal

Prepare for Rising Mortgage Rates: Tips for Home Owners, Home Buyers and Investors

Market volatility and rising mortgage interest rates can cause uncertainty for home owners and those looking to buy, but with the right tools, resourc...

-

Personal

Student Loan Interest Rate vs. APR: What's the Difference?

Resources and content provided by College Ave Student Loans A student loan interest rate and a student loan annual percentage rate (APR) are simila...

-

Personal

How to Find the Right Mortgage For You

With so many financing options available, shopping for a mortgage in today’s competitive real estate market requires experience and expertise. Tha...

-

Personal

Student Loans 101: How Do Student Loans Work?

Resources and content provided by College Ave Student LoansIf you’re thinking about taking out a student loan to help pay for college, you might be na...

-

News Releases

American Savings Bank Donates More Than $360,000 to Help Nonprofits and Community Recover From Pandemic

American Savings Bank's (ASB) 2022 Kahiau Giving Campaign raised $362,043, which will allow local community organizations to continue providing critic...

-

Business

Quick Tip Tuesday: Expand Your Business by Offering More Ways to Pay

Digital technology has given customers a lot more flexibility in how they can pay and has also made the process significantly less complicated for bus...

-

Community

NASA Astronaut Visits Hawaii Schools and Teaches Students to Dream Big

NASA Astronaut Dr. Michael Barratt visited three of American Savings Bank’s (ASB) Bank for Education Ohana Schools to talk to students grades K-5 abou...

-

News Releases

American Savings Investment Services Wealth Advisors Named 2022 Cetera Circle of Excellence Honorees

Three American Savings Investment Services wealth advisors, Angela Chow and Kanani Miyahira were recently named 2022 Cetera Circle of Excellence honor...

-

News Releases

American Savings Bank Announces 2021 Community Impact Contributions

American Savings Bank (ASB) announced its charitable contributions for the 2021 calendar year. In total, more than $1.5 million was donated to the com...

-

Business

What a Business Credit Card Can Do for You

As a business owner, managing your cash flow is probably one of your biggest priorities. Many business owners find that they need extra cash to cove...

-

Personal

Credit Cards vs. Debit Cards - What's the Difference?

Credit and debit cards often look nearly identical at first glance. When someone pulls a card out in the checkout line, you may not know if they’re us...

-

Personal

Choosing the Right Credit Card for You

Are you in the market for a new credit card? With all the options available, it’s hard to know which one is right for you. At American Savings Bank, w...

-

Community

#ASBPride: Manaola’s Story – The Search for Happiness

At American Savings Bank, we embrace and support customers and teammates from all backgrounds and sexual orientations. This diversity provides us with...

-

Community

#ASBPride: Elisia’s Story – Returning Home with Pride

American Savings Bank is committed to creating a diverse, respectful and inclusive company for our teammates and customers. We want people from all wa...

-

Personal

Be Aware of Ransomware

Ransomware is a form of malware designed to hold a victim’s files and device hostage until they’ve paid the demanded ransom. We’re here to help you le...

-

Personal

Step Up Your Game with These Cybersecurity Tips

With October being National Cybersecurity Awareness Month, Levi Carias, Director of Information Security, joins HI Now Daily to share tips and onlin...

-

Community

#ASBPride: John's Story - Embracing Your Pride

At American Savings Bank, individuals from all backgrounds, interests and sexual orientations are celebrated and supported. It’s important that we cre...

-

Community

Free Vaccination Clinics at Aala Park on Sept. 12 and Oct. 3

ASB is committed to doing our part to stop the spread of COVID-19 in the community. We are partnering with Hawaii Pacific Health to host two FREE COVI...

-

Personal

Getting Started with Clean Energy Financing

More and more homeowners in Hawaii are choosing to go green when powering their homes. Installing solar or other clean energy systems to power your ho...

-

Personal

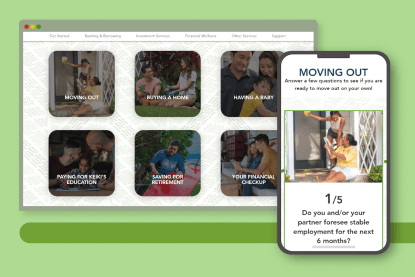

Boost Your Financial Health – Take Our Enhanced Financial Checkup!

Living in paradise isn’t cheap. On top of everyday expenses such as buying groceries and filling up gas, it may seem impossible to save enough money t...

-

Personal

Do You Have Enough Home Equity in Your Home to Refinance?

Do you want to refinance your mortgage? Whether you want to lower your interest rate or get rid of mortgage insurance, you’ll likely need to have equi...

-

News Releases

American Savings Bank Opens Kapaa Digital Center

American Savings Bank held a blessing ceremony today at its Kapaa Digital Center, located at 4-831 Kuhio Highway, Suite 150. This is the fourth and fi...

-

Personal

Detect and Deflect Identity Theft

Identity thieves are continuously finding new ways to steal your information, but we can help you remain one step ahead and avoid their tricks. Identi...

-

Personal

How to Calculate the Equity in Your Hawaii Home

Your home’s equity is the difference between what you owe on your mortgage and what your home is currently worth. In Hawaii, many homeowners decide to...

-

Personal

Budgeting Tools to Help You Get Started

Do you want to have more control over your finances? Are you looking for a way to make reaching financial goals easier? There’s no magic wand when i...

-

Community

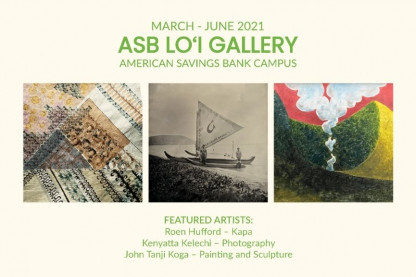

Meet Our Newest Lo‘i Gallery Artists

American Savings Bank’s Lo‘i Gallery is proud to introduce three new talented artists, each offering a unique perspective of and homage to the peopl...

-

Personal

Breaking Down Different Types of Bank Accounts

Opening a bank account is one of the most important decisions you can make, so it's important to have all the facts. Lance Masuda, Director of Custome...

-

Personal

Online Banking vs. Traditional Banking: What's the difference?

The rise of technology in recent years has also led to new ways to bank — online via web browsers and smartphone applications. Online banking has beco...

-

Community

ASB Is Proud to Celebrate National LGBTQ Pride Month

Happy National LGBTQ Pride Month! We’re proud to support the LGBTQ community all year long – including during National LGBTQ Pride Month every June an...

-

Personal

Comparing Mortgage Rates in Hawaii

Shopping for a home in Hawaii? Comparing mortgage rates is an important step in the home buying process. A lower interest rate could potentially sav...

-

Business

The Ins & Outs of Business Loans

Are you a business owner? A business loan can help you to cover unexpected expenses, explore a new market or grow your company. No matter what your dr...

-

Business

How to Save for Your Business

Owning your own business is exciting, but navigating the financial pieces can be challenging. Separating your business and personal expenses can hel...

-

Personal

Managing Debt in College and Beyond

The cost of higher education continues to be on the rise, with student loan debt becoming increasingly common among younger generations. Learning ho...

-

News Releases

American Savings Bank President and CEO Rich Wacker Announces His Departure; Executive Vice President of Operations Ann Teranishi Named as Wacker’s Successor

American Savings Bank (ASB) announced today that President and Chief Executive Officer Rich Wacker will leave the company to pursue other interests. T...

-

Personal

Tips to Manage Your Credit

Understanding your credit score and figuring out how to improve your credit may sometimes feel daunting, but it’s something that’s necessary, as it ca...

-

Business

Benefits of a Business Banker

Running a small business often means wearing many hats: you might be the founder, head of marketing, human resources manager and IT department of your...

-

Personal

Get to Know Personal Loans

Do you have a major purchase coming up, need to pay off debt or have an unexpected expense? A personal loan could help you to cover these costs by spr...

-

Personal

Armor Up Against Identity Fraud

Fraudsters these days are more conniving and persuasive than ever before. But, you can keep your identity and your finances secure all year round by s...

-

Personal

Investing in Your Financial Future

Investment planning is often one of the most stressful parts of planning for your financial future. You might be worried about potential market volati...

-

Personal

Understanding Interest Rates

You might have heard about interest rates but do you really know what they are and how they can help your finances? You might know that interest is th...

-

Personal

Using a Mortgage Calculator

Are you thinking of buying a home in Hawaii? Whether you’re a first time home buyer or are seeking to downsize in retirement, estimating your mortgage...

-

Personal

Celebrate Financial Literacy Month with These Useful Tips

April marks National Financial Literacy Month – a time when financial institutions like American Savings Bank help you to learn more about how you can...

-

Community

ASB Stands with Asian American and Pacific Islanders

We are deeply troubled and saddened by the rise in verbal harassment, senseless mistreatment and violent hate crimes targeted at Asian Americans and P...

-

Other

10 FAQS About Our Current Economy

The COVID-19 pandemic has made many unforeseen impacts on the United States economy, from nationwide unemployment to the affects it has had on trave...

-

News Releases

ASB Earns Great Place to Work® Certification

This month, American Savings Bank was officially certified a Great Place to Work®, a designation awarded to the top companies around the world...

-

Community

Meet Our Newest Lo‘i Gallery Artists

After a brief hiatus, ASB’s Lo‘i Gallery is back with three talented local artists, each representing a unique medium inspired by the people and natur...

-

Other

Are you working from home? Here's how to save money while doing so

The COVID-19 pandemic has led many workplaces around the world to transition employees to remote work. While working from home can be an exciting chan...

-

Personal

Saving at Any Age

Saving is an important step toward overall financial health. From a child’s first account to retirement planning, good savings habits can help you t...

-

Personal

Why you should get life insurance early

Life insurance isn’t something young adults consider an immediate need. You might understand the benefit of having a life insurance policy when you’re...

-

Personal

On-the-Go Banking Tips

The latest advances in banking technology have made everyday tasks like shopping, running errands and sharing a meal with friends and family safer and...

-

Community

Our Community Impact in 2020

2020 was a challenging year for many, with the drastic impacts the COVID-19 pandemic had on the economy and our local community. Many individuals an...

-

Personal

How to Stay Safe and Secure Online This Year

From working from home to distance learning, many of us are online more than ever before due to the global pandemic. With more time online comes mor...

-

Personal

Making Home Loans Easy – Our New Online Mortgage Application

From shopping to schoolwork, much of what we normally do in person has gone digital due to the pandemic. Now, with the latest technology from Americ...

-

Personal

How to Deal with the Financial Impacts of a Job Loss or Pay Cut

Unemployment is at an all-time high due to economic impacts of the COVID-19 pandemic. In August 2020, Hawaii had the country’s highest “insured unempl...