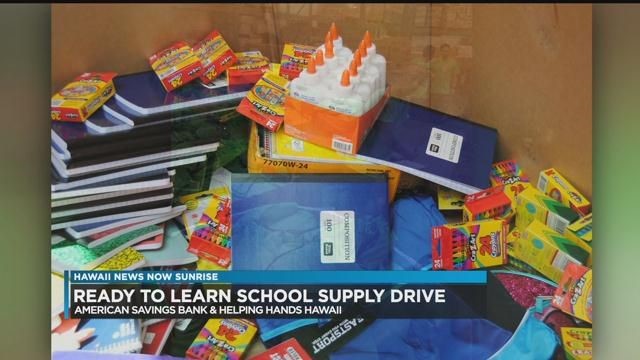

American Savings Bank is teaming up with Helping Hands Hawaii to gather as many school supplies as they can so no keiki goes back to school without having the necessary tools.

You can drop off supplies at any American Savings Bank across the state.

We spoke with Chereen Pires from American Savings Bank and Kristine Garabiles from Helping Hands Hawaii to find out more.

Hawaii News Now

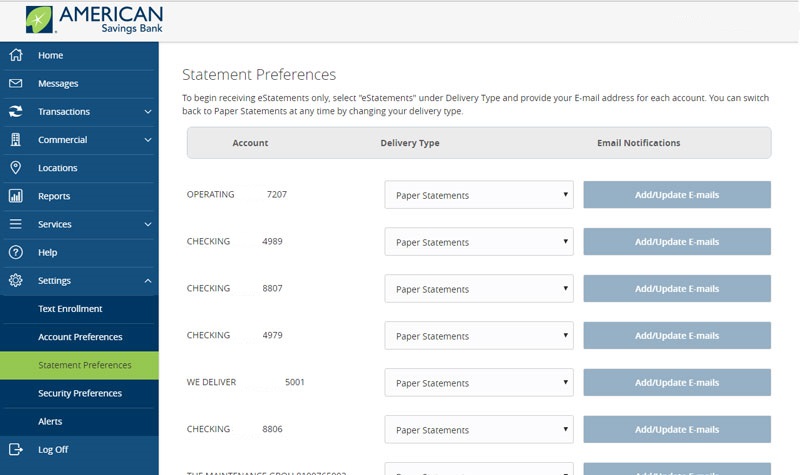

Ready to Learn (RTL), a program at Helping Hands Hawaii (HHH), will run its annual school supply drive for at-risk students from June 1 to July 31, 2018. The program gives low-income and houseless students free basic educational tools to aid in their scholastic development and contribute to a more prosperous future.

“Learning and self-esteem are affected when children don’t have school supplies they need on the first day of school or throughout the year,” said HHH President and CEO Jan M. Harada. “But, the community can directly support the educational experiences for local youth with just a small donation.”

Banking partner American Savings Bank (ASB) will collect school supplies and monetary donations from June 11 to July 11 at all of its branches statewide. Donation of school supplies on each island will remain on the island to benefit local students.

"School supplies have the power to drastically improve a student’s access to education and opportunities for success," said Beth Whitehead, executive vice president and chief administrative officer at ASB. "We are proud to support Ready to Learn, and hope the community will join us in donating school supplies and monetary donations to this important program."

School supply donations supplement pre-ordered, bulk supplies in school supply kits purchased with donated and grant-awarded funds for students of all grade levels. These kits contain common supplies found on the Department of Education’s back-to-school lists. Each kit is valued at approximately $10 each. Annually RTL distributes more than $50,000 in school supplies to more than 5,000 students across the state.

The school supplies in highest demand are: ballpoint pens (black or blue), binders (1 inch), blunt scissors (4.5 inch), composition books (wide ruled), crayons (24 count), erasers, folder paper, glue (4 ounces), pencils (No. 2), portfolio (2 pockets), rulers and spiral notebooks (1 subject, wide ruled).

To apply for the RTL program, students in grades K to 12 must be recommended by a case manager from a participating referral organization. Partner agencies include Catholic Charities Hawaii, The Salvation Army, Child & Family Service, Parents & Children Together, Liliuokalani Trust, Hawaii Department of Health, Hawaii Department of Human Services and other well-established social service providers. Students and their parents are encouraged to reach out to these organizations if they require assistance. The deadline to apply for the program is Friday, June 22, 2018.

In addition to donating at the nearest American Savings Bank, individuals, organizations and corporations can organize their own fundraising drives and volunteer to pack donated school supply kits by completing a RTL Community Partner Application. Email the completed form to RTL@helpinghandshawaii.org, and a RTL team member will follow up with additional information and assistance. A list of RTL Community Partners and donation drop-off locations will be listed at www.HelpingHandsHawaii.org as information becomes available.

Additionally, the public can donate to the RTL program using the following methods:

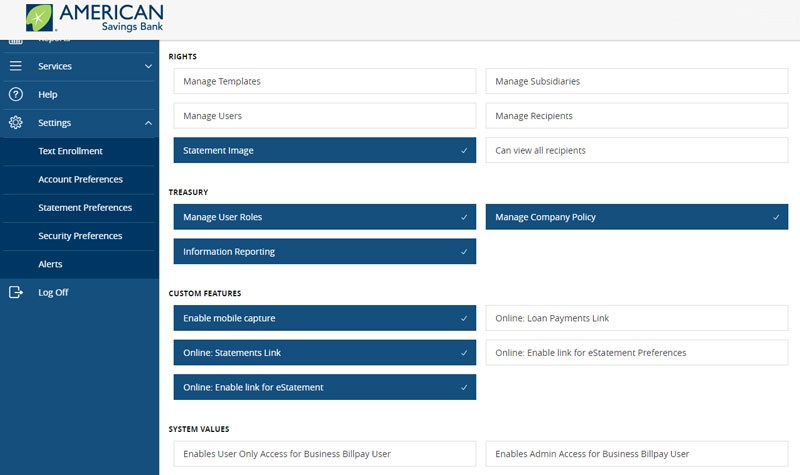

Online: Visit www.HelpingHandsHawaii.org and click on the PayPal link to make a gift. Contributions from June 1 to July 31, 2018 are automatically earmarked for the RTL program unless specifically designated elsewhere.

Mail: Checks made payable to “Helping Hands Hawaii” can be mailed to Ready to Learn Program, c/o Helping Hands Hawaii, 2100 N. Nimitz Hwy., Honolulu, HI 96819. Write “Ready to Learn” in the memo section.

In-Person: Cash, check and school supply donations are accepted at all ASB branches from June 11 to July 11 and on weekdays between 8 a.m. and 4:30 p.m. at Helping Hands Hawaii’s main office at 2100 N. Nimitz Hwy., Honolulu, HI 96819. For a list of ASB branches, visit www.asbhawaii.com/locations.

Copyright 2018. Hawaii News Now. All Rights Reserved.

Hawaii Public Radio

By DAVE LAWRENCE • JUN 8, 2018

This week on Helping Hand, join HPR All Things Considered Host Dave Lawrence for a conversation about the annual Ready to Learn program with Helping Hands Hawaii CEO and President Jan Harada. Jan explains that with half of all public school students in the Aloha State coming from households eligible for government-sponsored free lunches at school, the need is great. The school supply drive runs through July 31, giving low-income and houseless students free basic educational tools. American Savings Bank will collect school supplies and monetary donations from June 11 to July 11 at branches statewide, and people can donate at the Helping Hands Hawaii location and online.

Helping Hand is a weekly feature airing statewide on HPR1 stations each Friday as part of our afternoon drive broadcast of All Things Considered, and then appearing online here, where all of our Helping Hand segments and resources are archived online. Helping Hand puts the spotlight on an organization, topic or event that offers assistance to people with disabilities and others among the most vulnerable.

Contact Helping Hands Hawaii:

Phone: (808) 536-7234

READY TO LEARN DETAILS:

What Type of Supplies Are Needed?

RTL collects basic supplies, such as

-

Backpacks

-

Ballpoint Pens (Black or Blue)

-

Blunt Scissors (4.5 inch)

-

Composition Book

-

Crayons (24 Count)

-

Folder Paper

-

Glue (4 ounces)

-

Pencils (No. 2)

-

Portfolios

-

Spiral Notebooks (1 Subject, Wide Ruled)

Or a $10.00 donation can purchase the supplies needed to create one school supply kit for a child in need.