ATM

You can deposit checks at all ATMs located at our branches and other select full-service ATMs. Please visit locations page for a complete list of our ATMs.

Funds from deposits may not be available for immediate withdrawal. ATM deposits made before 4:00 p.m. Hawaii Standard Time (HST), Monday - Friday, excluding federal holidays, will be considered deposited on that day. ATM deposits made after 4:00 p.m. HST, will be deposited on the next business day. Please refer to your account rules regarding funds availability.

After entering your PIN, select "My Preferences" at the ATM and choose your default settings.

Yes, you are able to view your balance at the ATM on the screen or printed.

Withdrawals are limited to $500 per transaction. You can make multiple transactions up to your daily limit of $1000, or the available balance, whichever is less.

ONLINE BANKING ENROLLMENT

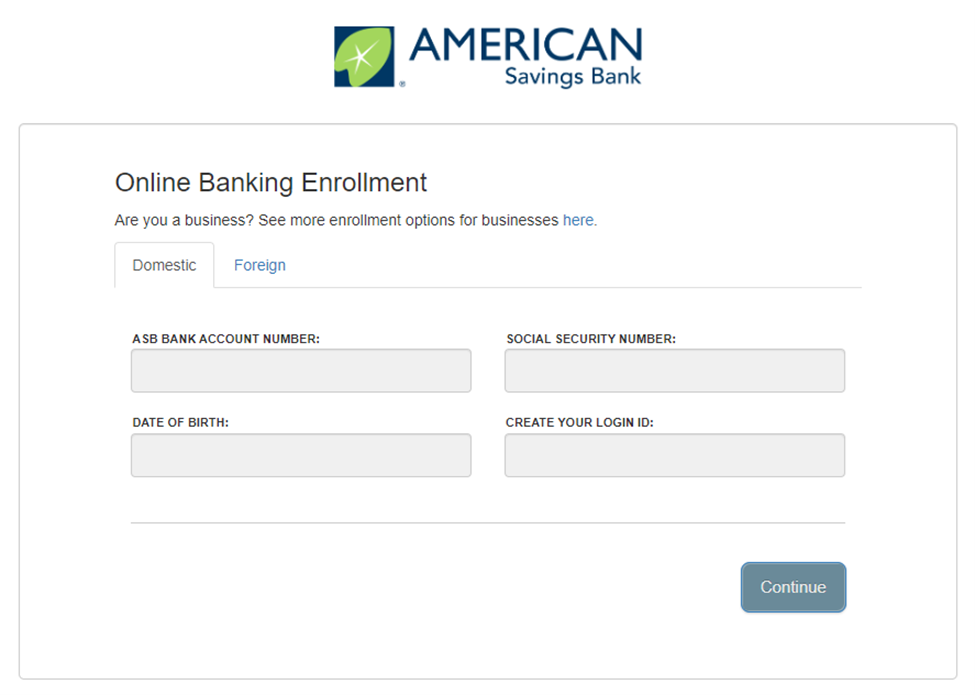

To enroll in Online Banking as a foreign customer follow these steps:

- Go to our Online Banking Enrollment page.

- Click on the ‘Enroll Your Personal Account’ button and a new secured window will appear.

- Select the ‘Foreign’ tab.

- To enroll you will need to provide the following:

- ASB Bank Account Number

- Account Type

- Date of Birth

- Your Requested Login ID

- Click the ‘Continue’ button and follow the authentication prompts in order to complete your enrollment.

Yes, you will need to enroll in online banking before you can access your accounts from the ASB Hawaii Mobile App. You can access the Enrollment page from asbhawaii.com or from the login page within the ASB Hawaii Mobile App. Once the enrollment process is complete, you can use the same Login ID to access your accounts via mobile and/or online.

To sign up for Online Banking you can enroll directly from our website, asbhawaii.com or by downloading our mobile app. To access Online Banking from your desktop, tablet, or mobile device, you only have to enroll once. This means you can use the same Login ID and Password to access Online Banking from any device.

To enroll in Online Banking, follow these steps:

- Go to our Online Banking Enrollment page.

- Click on the ‘Enroll Your Personal Account’ button and a new secured window will appear.

- Select the ‘Domestic’ tab.

- To enroll you will need to provide the following:

- ASB Bank Account Number

- Social Security Number

- Your Date of Birth

- Date of Birth

- Your Requested Login ID

- Click the ‘Continue’ button and follow the authentication prompts in order to complete your enrollment.

ONLINE BANKING LOGIN & SETUP

- Go to asbhawaii.com.

- Enter your Current Login ID and Password in the login field.

- You will be asked to update your password.

- For added security, you will be required to enter a Secure Access Code (either a text or phone call - message and data rates may apply).

Note: When you receive your six-digit Secure Access Code, enter it in the access code screen and click Submit. The Secure Access Code is only valid for 30 minutes. Don't forget to register your device. This will prevent you from having to request a new Secure Access Code when you use this device in the future (only select to register your device that you own and trust). If we do not have your current contact information you will not be able to access the Online Banking system.

To access mobile banking, you will need to download the ASB Hawaii mobile app from the App Store or Google Play.

Make sure that you’re using the most updated version of your web browser and operating system. Check our Online Banking Setup page for details.

Once the app is downloaded you can use your Login ID and Password to access Mobile Banking.

If you are not an existing online or mobile Online Banking user, you will need to enroll by clicking the "Enroll" link at asbhawaii.com or in the mobile app.

Visit the Online Banking Setup page for details.

A new enhanced security feature called "Secure Access Code" is required to access your accounts via Online Banking for the first time from any new device. This code is delivered to you via mobile text message or phone call. If do not have your correct information we will not be able to send you your secure access code.

If you do not have a U.S. phone number, please contact us at (808) 627-6900 or toll-free at (800) 272-2566 during business hours and we will give you a Secure Access Code.

If you forgot your Login ID, please contact us at (808) 627-6900 or toll-free at (800) 272-2566 during business hours for assistance.

If you forgot your password:

- Select the "Forgot Your Password" link in the login page.

- Enter your Login ID, press the Submit button.

- Request a Secure Access Code to be sent via text or phone call.

- Set your new Password.

Log in to Online Banking

- From the Menu, Select “Profile & Preferences” > “Text Enrollment.”

- Slide button "On" to enable Text Banking and enter your Mobile Number.

- Agree to Terms and click ‘Save’.

- Under "Settings," choose "Account Preferences" and click "Text" button.

- For each account, enter your account nickname (six digit name) and viewing order (1, 2, 3) and click the "Enabled" check box.

- Click "Submit" button.

- Once the above steps are complete, text us at 226563 and then enter LIST to receive list of commands.

- Message and data rates may apply.

Other Text Banking commands:

- BAL - Requests account balance

- HIST - Requests account history

- XFER - Transfer funds between accounts

- LIST - Receive a full list of available text command codes

- HELP - Receive information on how to contact us for help with text banking

- STOP - Stops all text messages to your mobile device

Your text banking messages will come from "226563."

Log in to Online Banking

- From the Menu, click on Profile & Preferences.

- Under Security Preferences, click on Alert Settings.

- Click the New Alert drop-down button. Choose the type of alert that you wish to create from the drop-down (Account, History, or Transaction Alerts).

- Select and complete the alert details.

- Click 'Create Alert.'

Note: Under ‘Security Alerts’, review and edit your Delivery Preferences (Email, Phone, Mobile).

Account, History, Transaction, and Security Alerts

- Log in to Online Banking.

- From the Menu, click on 'Profile & Preferences.'

- Click on 'Contact Information.'

- Review and update your email, phone numbers, Home Address, and Mailing Address.

For assistance, please contact us at (808) 627-6900 or toll-free at (800) 272-2566 during business hours.

- Log in to Online Banking.

- From the Menu, click 'Profile & Preferences.'

- Click 'Account Preferences.'

- Select the Account.

- Under the Details tab > Account Visibility, toggle on to view or off to hide an account from displaying on the Home page in online banking.

To add or delete an account please contact the Customer Banking Center during business hours via secure message in Online Banking.

To find our app, search using the terms "ASB Hawaii Mobile" or "American Savings Bank Hawaii".

Online Banking allows you to group account. If you click on an account from the home page, the tray icon will appear in the lower right corner of the page. You can then drag and drop the accounts you want to group into this tray. After that you can rename the group to an account nickname.

- Log in to Online Banking via ASB Hawaii Mobile App.

- From the Menu click on "Profile & Preferences."

- Under Security Preferences, click on "Touch/Face ID."

- Toggle on your desired preference (Passcode and/or Touch ID).

- Follow the setup instructions (You will be asked to enter your login ID and password to complete this setup).

For assistance, please contact us at (808) 627-6900 or toll-free at (800) 272-2566 during business hours.

SECURITY BROWSER INFORMATION

When you enter your Secure Access Code, we will ask if you would like to trust this device.

- If you select "trust this device" then you no longer need a Secure Access Code for that device. We recommend selecting this option for your personal devices including your computer, laptop, tablet, and mobile phone.

- If you do not select this option then you will be required to obtain and enter a Secure Access Code each time you login.

If you have locked your account due to several unsuccessful login attempts, for your security please contact us at (808) 627-6900 or toll-free at (800) 272-2566 and press 0 for Online Banking Help to unlock your account.

TRANSFERS & PAYMENTS THROUGH ONLINE BANKING

You can send money to / from an external account to / from your ASB account:

- Call Customer Support Center during business hours for assistance setting up your external accounts.

- Once we set up your access in online and mobile banking, click on Payments & Transfers

- You will need your account and routing number from your other financial institution. These numbers can be located towards the bottom of a paper check.

- For security purposes, you will be asked to verify your ownership of the external account via 2 small micro deposits made to your account.

- You should then receive micro deposits in approximately 3 business days deposited to the external account to show the process has been initialized.

- Once you see that you have received these deposits, go to Transactions > Verify External Account to enter the amounts and activate your external account.

- Click on "Pay & Transfer."

- Click on "Verify External Account."

- Select the Account you would like to verify.

- Enter the amounts of the micro deposits that you see in your external account.

You will need to check your external account in approximately 2-5 business days to confirm that the deposits have been made. Then follow the instructions on the 'Verify External Account' page.

We will begin processing an external transfer on the same day only if we receive the request prior to 12:10 p.m. Hawaii Standard Time (HST). Requests made after 12:10pm HST will be processed on the next business day.

You can make a one-time or recurring transaction. Click on Pay & Transfer > Make a Loan Payment, and fill out the information on the Loan Payment page.

To get started, log in to Online Banking and select Pay & Transfer > Online Bill Pay.

You may stop the Bill Pay service by contacting us at our Customer Banking Center at (808) 627-6900 or toll-free at (800) 272-2566 during business hours. You may also cancel your bill pay service, by sending a secure message through online banking. Follow these steps:

- From the main menu, click "Messages."

- Click on the pencil icon, or click "Create a message."

- Select a recipient, create a subject and enter a message.

- Click "Send message."

eSTATEMENTS

- Log in to Online Banking or ASB Mobile app.

- From the main menu > Statements > View Statements.

- Using the drop-down boxes, select an account and the dates for the statements that you wish to view. Click "Continue."

- Your eStatement will be displayed as a PDF. You can download or print your statement up to two years.

Note: Be sure you are using a supported OS and browser to properly view the PDF on your device.

Yes, you can view and enroll from the ASB mobile app. Learn more here.

SETUP DIRECT DEPOSIT ONLINE

ClickSWITCH is an automated account switching solution that makes it easy for you to quickly and securely setup a new direct deposit or switch your recurring direct deposits from your previous financial institution account to your American Savings Bank account.

ClickSWITCH removes the hassle of contacting your depositors (i.e. Employer) to inform them of your new account information. You input your direct deposit information to our secure ClickSWITCH system, submit the switch and we’ll do the rest. You can monitor the progress of your switches by clicking on the “View Existing Switches” on the home screen of your Dashboard.

Yes. ClickSWITCH uses the latest in online encryption protection to gather and store your switch information. Additionally, our facilities adhere to the highest industry standards with regard to the security of your personal information.

You’ll need to gather all of your direct deposit information to get your switches started. A previous statement (i.e. paystub) is a great source of information for direct deposits tied to an account.

A direct deposit is any payment that you receive from an organization directly into your account. These could include payroll direct deposits, government direct deposits (Social Security, Disability, etc.) and dividend direct deposits from investment accounts.

Submitting a switch typically takes less than 10 minutes.

We display the status for each direct deposit on the ClickSWITCH dashboard under the button titled “View Existing Switches.” For switches that are marked as “Mailed” for more than 15 business days, you may want to contact the depositor to confirm the status and see if the company needs additional information. You can also monitor your ASB account to see if it reflects you new deposit after 2-3 pay cycles of submitting your switch.

Companies require specific information to ensure your identity and to update the account information in their system.

A large number of depositors are already in our system. However, if we do not have a company’s address, please use the address that is indicated on your paystub sent by your employer/depositor. You can also typically find the address displayed in the Help or Contact Us areas of the company’s website.

If a field has an asterisk on the right, this information is required in order for the switch to be submitted. If you are in the middle of a switch, you can click “Save and Continue Later”. It will save as an “Information Needed” status and you can re-visit that switch by clicking on the ‘View Existing Switch’ button.

The easiest way to check the status of a switch is to verify that your ASB account is reflecting the new deposit request within 2-3 pay cycles of submitting your request.

We recommend waiting until the customer sees the new deposit reflected in their ASB account.

Occasionally, after you have submitted a switch for processing, our research team determines that the company requires you to update your banking information with them online. When this happens, your switch will show an “Action Needed” status. You may also see an “Action Needed” status if the switch is rejected for other reasons. To see the details of the action you need to take, you can click on the Edit icon in the Actions column.

You will receive switch updates via email. Please be sure to verify your email address in Online Banking by visiting the ‘Manage Contact Information’ page from the Menu > ‘Settings’.

Please contact our Customer Banking Center at (808) 627-6900 or toll-free at (800) 272-2566 during business hours.

HOME EQUITY LINE OF CREDIT (HELOC)

Your account should automatically be visible in online and mobile banking, but if you are unable to view your HELOC account, contact the Customer Banking Center at (808) 627-6900 or toll-free at (800) 272-2566 during business hours.

PERSONAL CHECKING

You can access your checking account via online banking, mobile banking, ATM, bank by phone at (808) 627-6900 or toll-free (800) 272-2566 during business hours or in any American Savings Bank branch.

There’s a couple different ways to set up direct deposit. For more information, click here.

1st time check orders:

To order checks from our check provider, Deluxe, please call 1-877-838-5287 or place an order online. You can select the quantity and style of checks you wish to order. You will need the bank routing number (321370765), your checking account number, and the next check starting number.

Reorders

You may reodrer checks though our Online Banking or Mobile Banking App or through our check provider, Deluxe, please call 1-877-838-5287. You can change the quantity and style of checks you wish to order.

Setting up automatic transfers including loan payments is easy with Online Banking. Click here to learn how >

You may also use the Automatic Payments and Transfers Form to set up automatic transfers to or from your accounts. If you are withdrawing from a non-ASB account, you will need the account number and routing number, a voided check, or a copy of your statement. Return the form to any branch or mail to:

American Savings Bank

Attn: ACH Services

P.O. Box 2300

Honolulu, HI 96804-2300

We need 5 business days from the date of receipt of your form to set up, change, or cancel your transfer. For loan payments we will send you a letter confirming the start date of your first automatic payment. Please continue to make your payments until you receive your confirmation letter.

We typically show two balances, current balance and available balance.

The current balance is the total amount of money available in the account before pending transactions clear. You can view your current balance with Online Banking under "Account" and click on the "Details" tab.

The available balance is the amount of funds that are available to you after pending transactions clear. Always use the available balance when monitoring your account.

Your ATM fee rebate will be credited to your account at the end of your monthly statement cycle.

We recommend using our Customized Account Chooser or visit us at a branch and we'll explain the benefits and differences of our family of checking accounts.

You may receive a hold on your deposit for any number of reasons. For instance, we may place a hold if your account has been open for 30 days or less, you have overdrawn your account repeatedly in the last six months, a check you deposited was previously returned unpaid, the checks you deposited in one day exceeded $6,725, or due to an emergency as a result of failure in computer or communications equipment. Please contact our Customer Banking Center at (808) 627-6900 or our toll-free number at (800) 272-2566 during business hours for any more questions.

The Kalo EssentialsSM Checking account does not require a minimum balance. However, in order to avoid monthly service fees, Kalo PlusSM Checking and Kalo DeluxeSM Checking do require a minimum balance. For information on balance requirements and more, visit Compare All Checking Accounts.

Interest is compounded daily and credited to your account monthly. If your account is closed or is transferred to a non-interest bearing account before interest is credited, you will not receive the accrued interest. If the interest amount calculated for the monthly cycle is less than half a cent, interest will not be paid.

For checking and money market accounts, a statement will be provided to you monthly. For savings accounts a statement will be provided to you at the end of each calendar quarter. You will receive an additional statement for any month in which you perform electronic fund transfers. If your savings account is part of the combined statement, a monthly statement will be provided instead of a quarterly statement.

The interest rate and annual percentage yield ("APY") on your account are shown in the separate Customer APY and Interest Rate Sheet ("Rate Sheet"). Your interest rate and APY may change. At our discretion, we may change the interest rate on your account at any time. An APY is an annualized rate that allows you to compare rates across deposit products. View the rates.

A checking account is considered dormant at 12 months of inactivity, and a savings account is considered dormant at 36 months of inactivity. While your account is dormant, you will receive account statements but will not be able to access the ATM or use your debit card at point-of-sale (POS) terminals.

To cancel automatic transfers, complete Section II of the Automatic Payments and Transfers form and submit it to us at least 5 business days before the scheduled cancel date. For your automatic transfers to continue without interruption, complete Section I of the form and return it in at least 5 business days before the scheduled transfer date. For more information, visit common forms.

You should receive your ASB Visa® Debit Card approximately 4-6 days after you open your account. Your checks should arrive approximately 10 days after you open your account.

To place a stop payment visit the branch or call our Customer Banking Center at (808) 627-6900 or our toll-free number at (800) 272-2566. Fees may apply.

To place a stop payment in online banking for a single check:

- Click on the "Self Service" tab.

- Click on the "Request Stop Payment" link.

- Use the dropdown list to select the account from which the check was issued.

- Enter the check number and enter the date of the check.

- Enter the check amount and use the dropdown list to select a reason for the stop check request.

- Select "Next" to continue and confirm the stop payment request.

PERSONAL SAVINGS

The minimum balance to open a savings account will depend on the type of account. For complete details on balance requirements and monthly service fees, visit Compare All Personal Savings Accounts.

Both a Money Market Savings account and Tiered SavingsSM account pay higher interest for higher balances. The difference between the accounts is the Money Market account provides the ability to write checks and the Tiered Savings does not.

To compare savings accounts, click here.

The Moneyhune Savings account is especially designed for keiki under the age of 18. It can be converted to a Statement Savings account when the individual turns 18 years old. We also offer investment and savings accounts used for education. Speak to a Financial Advisor for more information about Education Planning.

The Holiday Savings account is an easy way to save for the holiday season you are set up with automatic transfers into your account. On October 31st, we automatically transfer your funds to your designated ASB account.

To compare savings accounts, click here.

CERTIFICATE OF DEPOSIT (CD’s)

CDs and savings accounts are tools to help support your financial goals. A CD offers a higher interest rate to meet longer term savings goals and offers a higher rate than associated with a business or personal tiered savings account. However, accessing funds in a CD before the maturity date may result in an early withdrawal penalty. A savings account can be used to meet shorter term savings needs such as an emergency fund. Access to funds in a savings account may require you to give us seven (7) days advance notice if you plan to withdraw funds. For more information, please visit personal CDs or business CDs.

Your account will automatically renew at maturity, but you will have a grace period of ten days after the maturity date to withdraw your funds without being charged an early withdrawal penalty. The renewed account will be for the same term as the original term, at the non-promotional interest rate and APY in effect on your maturity date.

If you withdraw any principal before the maturity date, a penalty may be imposed. The penalty amount, or any portion thereof, will be deducted from the amount withdrawn. Also, the penalty will not be imposed if the withdrawal is due to the death or legal incompetence of any depositor listed in the account name. For more details on account terms and penalty amounts, please visit the Deposit Terms and Conditions.

Interest that you earn on your CD is usually treated as income and reported as part of your income tax returns. We will provide for you a 1099-INT statement at the beginning of the following year. But everyone's situation could be different, so consult a tax expert.

IRA

Contributions into a traditional IRA can be tax deductible and can lower your taxable income. Your earnings also grow tax deferred. However, contributions are not tax-deductible with a Roth IRA. For more information, consult your tax advisor and visit personal IRAs comparison page.

A Bank IRA is when you put your funds into a savings or CD account. A Brokerage IRA is when you put your funds into an investment such as mutual funds, stocks, and bonds. To learn more, contact a Financial Advisor to find out what products may fit your needs.

Yes, there are annual contribution limits for a Traditional and Roth IRA. Visit personal IRAs comparison page for more information.

Traditional and Roth IRA CDs have early withdrawal penalties that depend on the specific account terms. Also, withdrawals made before 5 years and before the age of 59 1/2 may be subject to an additional IRS penalty. For details on account terms and penalties, consult your tax advisor and visit personal IRAs.

For more information about traditional IRA distributions, visit www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs. For more information about Roth IRA distributions visit www.irs.gov/retirement-plans/roth-iras.

Every individual's situation is unique. Please call the Retirement Savings Department number at (808) 735-1717 or our toll-free number at (888) 343-5534 and consult your tax advisor.

LONG TERM CARE INSURANCE / LIFE INSURANCE

Term insurance provides a level premium and a level-death benefit protection for a stated period of time, such as 10 or 20 years. Term insurance can be a good fit for younger individuals and families, who need protection against the loss of income of a primary earner for a stated period of time, at an affordable cost. It has no savings component. In most cases, a medical examination will be required. Permanent insurance typically provides both a death benefit and a savings component. There are different types of permanent insurance, including whole life, universal life, index-universal life, variable life and variable-universal life. Permanent insurance may provide protection for your entire life. If a guaranteed level premium is important to you, make sure your policy provides for one. Permanent insurance accumulates a cash value, and the policy owner may be able to borrow against it tax-free or use it for retirement or other goals (like education). Premiums are initially higher than for term coverage.

| Not FDIC Insured |

| Not Bank Guaranteed |

| May Lose Value |

| Not Insured by any Federal Government Agency |

| Not a Bank Deposit |

- How much of the family income do I provide?

- If I were to die, how would my survivors, especially my children, get by?

- Does anyone else depend on me financially, such as a parent, grandparent, brother or sister?

- Do I have children for whom I would like to set aside money to finish their education in the event of my death?

- How will my family pay final expenses and repay debts after my death?

- Do I have family members or organizations to whom I would like to leave money?

- Will there be estate taxes to pay after my death?

- How will inflation affect future needs?

| Not FDIC Insured |

| Not Bank Guaranteed |

| May Lose Value |

| Not Insured by any Federal Government Agency |

| Not a Bank Deposit |

You may have enough coverage from your employer, however, you will want to think about what will happen to that coverage if you leave your current employer. Is it portable? Will the premiums go up as you get older?

| Not FDIC Insured |

| Not Bank Guaranteed |

| May Lose Value |

| Not Insured by any Federal Government Agency |

| Not a Bank Deposit |

DEBIT CARDS

Yes, each account holder can be issued a debit card.

After receiving your card in the mail, follow the card activation instructions that came with your card. To set your PIN and/or activate your card, you may call (808) 627-6900 or toll-free 1 (844) 728-3418 during business hours.

You can get cash back when you use your Visa® Debit Card at ATMs and many merchant locations. To get cash from a merchant location, press DEBIT instead of CREDIT. You will be prompted to enter your PIN and select the amount of cash that you want to complete the transaction.

Many merchants do not require a PIN or signature for small dollar transactions for a Visa® Debit Card. This helps speed up checkout. Similarly, when you shop online or by phone signatures and PINs are not required.

Yes, when you request one, you are provided with a free debit card with your checking account.

The Gold card is usually linked to a Kalo Essentials account and the Platinum card is assigned to Kalo Plus & Kalo Deluxe. The Platinum Debit Card provides a higher dollar amount of ATM withdrawals than the Gold Debit Card.

If your debit card is lost or stolen, call our Customer Banking Center immediately at (808) 627-6900 or toll-free at (800) 272-2566 during business hours.

If you are upgrading from Kalo EssentialsSM Checking to Kalo PlusSM or Kalo DeluxeSM Checking and choose to upgrade to a Platinum Debit Card:

- You will be assigned a new Platinum Debit Card account number.

- If using your Gold Debit Card to make automatic payments, contact each payee and update them with your new Platinum Debit Card account number once you receive it.

- Your existing Gold Debit Card will be deactivated 30 days after you upgrade to a Platinum Debit Card.

PERSONAL LOANS

Depending on what type of loan you have, your first payment will be due about 30 days after the date of your loan.

HOME EQUITY LINE OF CREDIT (HELOC)

You will receive your checks by mail 7 to 10 business days after your funds have been approved.

Use the Automatic Payments and Transfers form to set up automatic transfers to or from your accounts. If you are withdrawing from a non-ASB account, you will need the account number, routing number, and a voided check or a copy of your statement. Return the form to any branch or mail to:

American Savings Bank

Attn: ACH Services

P.O. Box 2300

Honolulu, HI 96804-2300

We need 5 business days from the date of receipt of your form to set up, change, or cancel your transfer. For loan payments we will send you a letter confirming the start date of your first automatic payment. Please continue to make your payments until you receive your confirmation letter. You may also set up automatic transfers using ASB Hawaii Online.

A Home Equity Line of Credit (HELOC) is a line of credit secured by the available equity of your Hawaii home. The available equity of your home is the total value of your house minus the amount you still owe on it. For example, if your home is worth $500,000 and you still owe $200,000, your equity in the home is $300,000. A HELOC is used to access your equity in a credit line that can be used to purchase the things you want or need. Many Hawaii residents use HELOCs to make renovations, complete home improvement projects, or make a major purchase.

You can access your Equity Express Home Equity Line of Credit by Equity ExpressSM check, at a branch, or through transfers in online banking.

For owner-occupant borrowers applying for a line amount up to $400,000, ASB will waive most fees or closing costs associated with your HELOC application. Click here to learn more.

For Home Equity Line of Credit accounts, the due date is 25 calendar days after the statement is generated. Statements generate on the 20th of each month. If the 20th falls on a weekend or holiday, it will generate on the prior business day.

If you are eligible for the current introductory rate, your account will automatically go to the variable rate on the next statement cycle. The change in rate will be indicated on your statement.

To exercise the FRELO, you may visit a branch to sign an Addendum and the Request Form.

Yes, additional principal payments may be made with no additional charge.

Home Equity Line of Credit accounts up to $400,000 (excluding properties listed for sale within the prior six months), American Savings Bank (ASB) will pay or waive fees and costs for flood certification (up to $9), bank’s title insurance (up to $150), credit report (up to $4.50 per borrower), condo review, mortgage recording and valuation through an automated valuation model and property condition report (up to $185) of ASB’s choice; however, at their own cost, customers may request an appraisal at an estimated cost between $500 and $1,500. There is a $500 early close fee if the line is closed within the first 3 years. See HELOC terms and conditions for situations where the early close fee will not be charged.

Both terms have the same meaning. When you "advance" or "draw" on the line, which means you are using a portion of your available credit for the purchase. The line can be advanced or drawn in multiple ways including recurring bill payment, Equity ExpressSM checks or ASB Hawaii Online ASB Hawaii Mobile transfer of funds, etc.

MORTGAGES

Yes, on the Automatic Payment and Transfers Form select the Minimum monthly payment + additional principal of $__________ option. You can make additional payments and apply them towards your principal balance. The additional amount you provide will not change until you notify us in writing.

Jumbo Loans are any loans over the conforming loan limit set annually for each county by the Federal Housing Finance Agency.

There are a couple of items you must consider before applying for a mortgage. We recommend that you have a good understanding of how much you want to borrow, what your credit score is, and that your financial information is readily available.

We typically ask for two years of W-2s and tax returns as well as other documents to verify the information that you provide to us. Every applicant is different, so please contact a loan officer to discuss your situation.

Getting pre-qualified before applying for a mortgage is helpful. Knowing how much of a home you can afford will also help in the house hunting process.

Make every effort in making your monthly mortgage loan payment on time in accordance to your mortgage and note. If you have an automatic payment set up from a checking account, be sure to have sufficient funds before the date of the debit. If you make your mortgage payment online, be sure to give yourself lead time for the transaction to occur before the due date. If you experience challenges with your automatic payment, your online bill payment, or are unable to pay your mortgage, contact our customer banking center immediately at (808) 627-6900 or our toll-free number at (800) 272-2566 during business hours.

A residential first mortgage is secured by residential real estate property. Therefore, sufficient hazard insurance in case of fire, hurricane, flood and other disasters is required at all times. You must obtain and pay for the premiums if the mortgage is for a purchase of a new home; you must obtain sufficient coverage if the mortgage is for a refinance of an existing home. After mortgage loan closing and the mortgage account is established, an escrow account is used to collect the premiums monthly as part of your mortgage loan payment. A conventional 1st mortgage amount over 80% loan-to-value (LTV) requires private mortgage insurance (PMI), which is paid by the borrower and protects the lender from borrower default on loan payments. PMI cancellation is typically permitted: 1) borrower-requested cancellation, and 2) lender-required cancellation under the Homeowners Protection Act of 1998. For a borrower-requested cancellation, the borrower must provide a written request for cancellation to the lender on the date that the mortgage loan balance is first scheduled to reach 80% of the original value of your home. Certain conditions apply for PMI cancellation.

Borrower situations vary. Contact a loan officer who can provide you with a free analysis.

Please download our Reconsideration of Value form. Once you complete the form, please scan and email it to ResidentialAppraisal@asbhawaii.com. An ASB representative will contact you as needed.

OVERDRAFT PROTECTION

Your account becomes overdrawn when you make a withdrawal (typically made by check, debit card, ATM card, or electronic payment) for an amount greater than the available balance in your account.

We offer the following overdraft protection programs that may be less expensive than our standard overdraft practices:

- Savings Overdraft Transfer service links your checking account to your savings account. This program will transfer available funds from your savings account to your checking account when it is overdrawn. A transfer fee may apply.

- Preferred CreditLineSM is a line of credit that can be linked to your checking account from which funds are transferred to your checking account when it is overdrawn. An annual fee and finance charges on the outstanding balance apply. This program is subject to credit approval. For more information, go to overdraft protection.

We do authorize and pay overdrafts for the following types of transactions (we refer to this practice as Overdraft Courtesy):

- Checks and other transactions made using your account number

- Automatic bill payments (including preauthorized debits to pay bills automatically from your account, online bill payments, and recurring bill payments using your debit card)

If you want us to authorize and pay overdrafts for your ATM and everyday debit card transactions, you must first be enrolled in Online Banking. Then log in to Online Banking and go to "Menu", "Services" and then click or tap on "Overdraft Solutions" to make your selection from the drop-down menu. You have the right to revoke this consent at any time.

We do authorize and pay overdrafts for the following types of transactions (we refer to this practice as Overdraft Courtesy):

- Checks and other transactions made using your account number.

- Automatic bill payments (including preauthorized debits to pay bills automatically from your account, online bill payments, and recurring bill payments using your debit card).

We do not authorize and pay overdrafts for the following types of transactions, unless you ask us to (we refer to this as Debit Card Coverage):

- ATM transactions (including withdrawals, transfers, and gift certificate purchases).

- Everyday debit card transactions (which includes one-time bill payments using your debit card).

We pay overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any type of transaction.

If we do not authorize and pay an overdraft, your transaction will be declined. If overdrafts are not paid, we will charge a Returned Item fee. For more information, visit overdraft solutions.

No, there is no guarantee that every overdraft will be paid, even if you opt-in for Debit Card Coverage. However, if you do not opt-in to Debit Card Coverage, your one-time debit card transactions will definitely not be paid. For important information, visit overdraft solutions.

Yes. You may have an overdraft protection service and Debit Card Coverage. The benefit of having both is that we may be able to pay a transaction using our Debit Card Coverage if your overdraft protection is not able to cover your one-time debit card and ATM transactions. For more information, visit overdraft solutions.

A Preferred CreditLineSM gives you a source of funds to draw from that are automatically transferred if you ever overdraw your checking account. You will be charged interest on the outstanding balance based on your credit agreement. You may apply in a branch or online at ASBHawaii.com/personal/loans/overdraft-protection. Plus, the annual fee is waived for Kalo PlusSM and Kalo DeluxeSM checking customers.

STUDENT LOANS

American Savings Bank is proud to collaborate with College Ave Student Loans to offer simple and personal private student loan products that help parents and students fill financial gaps when federal loans, scholarship and grants aren’t enough to cover the full cost of undergraduate or graduate school.

There are a variety of loans offered for students in all levels of their educational career including: Undergraduate and Graduate Student Loans, Parent Loans and Student Loan Refinancing.

Borrowers can use their approved loan to pay for tuition and fees, books and supplies, room and board, transportation and personal school-related expenses.

In-school loans offer flexible repayment terms between 5 and 15 years to help you select the best plan based on your needs and goals.

No, however, you must be enrolled in a degree program and be attending class full time, half-time or less than half-time at an eligible school. Graduates may apply for the refinancing product after graduation.

No, there are no application or origination fees.

Please visit https://www.collegeavestudentloans.com/ to see current rates. Your specific rate will be based on several factors, including your credit score, loan term and repayment term selection.

Consumers can apply and receive a decision within 3 minutes. If approved, you will be prompted to configure your loan and be provided with terms and loan documents to read, accept and e-sign, which can be completed right after approval.

After receiving your loan approval, College Ave will send the loan for certification to your school. Once College Ave receives the approved certification, they will schedule the funds to be sent according to your school’s requested timeline.

The entire process, from application to sending the money to your school, is completed in as little as 10 business days, depending on your school’s processing time.

Refinance loans are disbursed directly to the current loan servicers.

A College Ave student loan applicant will find that the 3-minute application, from beginning to end, is simple. With an instant credit decision, personalized resources to fit your needs and goals and tools to support you every step of the way, applicants will find an easy and convenient process through College Ave.

There are numerous financial tools that students can use to pay for their education. Generally, when students apply for financial aid, their school will offer grants and federal student loans as part of the package.

- Grants are awarded by the government based on financial need indicated through the Free Application for Federal Student Aid (FAFSA) and do not need to be repaid.

- Federal Student Loans are fixed rate loans offered by the federal government after a FAFSA application is received. Payments for such loans aren’t typically due until after the student graduates, leaves school or changes their enrollment status to less than half-time. Federal loan options include Direct PLUS, Direct Subsidized and Direct Unsubsidized loans.

- Private Student Loans help parents and students fill financial gaps when federal loans, scholarship and grants aren’t enough to cover the full cost of undergraduate or graduate school.

Please visit www.collegeavestudentloans.com/faqs for more information.

Please visit www.asbhawaii.com/studentloans to apply. This will ensure that American Savings Bank – Hawaii receives credit for all referred applications.

GETTING STARTED

To add an additional business account to online banking, please contact us at (808) 627-6900 or toll-free at (800) 272-2566 during business hours press 0 to speak to a Customer Service Representative or visit a branch near you.

Check the location box and make sure that the address was typed properly. If after three attempts you still do not connect, please contact the Cash Management Services Department.

BUSINESS CHECKING

Your monthly transaction volume needs will help you determine which business checking account is right for you. Fees are based on the number of transactions and the amount of cash you deposit per month.

To compare all business checking accounts, click here.

Yes, each business checking account requires a minimum opening deposit.

For account opening minimums and balance requirements and to compare all business checking accounts, click here.

Yes, you are provided a debit card with your checking account.

To order business checks, please call Deluxe at (800) 865-1913 or order online any time.

BUSINESS SAVINGS

Both a Biz Money MarketSM account and Biz Tiered Savings account pay a higher interest rate for higher balances. The difference between the accounts is the Money Market account provides the ability to write checks and the Biz Tiered Savings does not.

To compare business savings accounts, click here.

You may deposit funds to your savings account at any branch or full service ATM, or make online transfers using business internet banking. You may also set up recurring transfers using the Automatic Payments and Transfers form.

We offer options for domestic and foreign wire transfers. Visit a branch or call the Customer Banking Center at (808) 627-6900 or our toll-free number at (800) 272-2566 during business hours for assistance. Download Wire Transfer Request form.

SBA LOANS

To apply for an SBA loan, visit a branch and we'll help you complete the application process.

BUSINESS TERM LOANS

You may view your balance on your monthly statement or access your accounts anytime using Online Banking for Business. Click here to login or enroll in Online Banking.

BUSINESS POWERLINESM

- You may transfer funds to your other ASB accounts with Online Banking for Business. click here to login or enroll in Online Banking.

- Withdraw funds using your special Business PowerLine checks. To order checks, please visit a branch.

- Visit a branch to withdraw funds from your account.

COMMERCIAL BUSINESS ONLINE BANKING

For security reasons, passwords must be reset every 90 days.

Please call us at (808) 627-6900 or toll-free at (800) 272-2566 during business hours or send a secure message and we’ll assist you with this request.

At this time you are able to see all business accounts (business checking, analyzed business checking, business savings, and money market accounts).

Yes, you can choose to receive a variety of account, history and online transactions alerts. You can set up to receive these alerts via email, SMS messages, or push notification on your device. To manage your alerts, from the main menu > Profile & Preferences > Alert Settings.

Note: Make sure you check out the "Edit Delivery Preferences" page and agree to terms.

SECURITY & BROWSER INFORMATION

Reputable websites like ours have a clear personal information policy that you should always read. Some sites require personal information as a part of the registration process. As a general rule, you should not provide information that you would normally not share with the institution.

American Savings Bank follows strict guidelines regarding the client confidentiality. How we collect information and how we use it can be found at Your Personal Information. Also, visit our Security Center for tips on staying safe.

Be sure that you are visiting a legitimate website. Do not respond to or enter information in emails or linked websites that ask you to provide confidential information, like your card number and PIN. American Savings Bank does not request personal or confidential information from customers by email.

Use the latest version of your browser and keep your operating system updated.

Keep your password confidential. Change it frequently (at least every 90 days) to ensure that no one else can guess it, and do not let anyone else use it.

Never walk away from your computer without exiting the system first. When you are finished with your banking, click the "Sign Off" button. Once you end your session, no further transactions can be processed until you sign onto the system again.