Benefits of a Business Banker

By

ASB May 03, 2021 | 5 min read BusinessRunning a small business often means wearing many hats: you might be the founder, head of marketing, human resources manager and IT department of your company all at the same time. There’s no reason you should have to take on every role in your business on your own, especially when it comes to the financial health of your business.

Forming a relationship with a business banker can remove some of the stress from running a business. It gives you the chance to work directly with a financial expert who has experience helping Hawaii business owners.

Who is a Business Banker?

A Trusted Advisor

A major benefit of a business banker is their ability to become your go-to source for actionable business advice. Experienced bankers know what it takes to run a successful business. Your banker can help answer your questions about your financials. They’ll help you understand when to take advantage of growth opportunities, how to manage your day-to-day finances, and what products are available to make money management easier.

The best bankers will help you see both the strengths and weaknesses of your business and give you the tools you need to improve the weaknesses. There’s a good chance they’ve already seen other businesses with similar challenges and can give you creative solutions based on what worked for other clients. They should help you develop a variety of solutions rather than just pushing bank products. For example, your business banker may suggest a business loan to help cover upcoming business expenses. At the same time, they may also direct you to helpful marketing resources that can help you increase your profits.

An Advocate

While your banker should help answer your financial questions, you also want them to ask questions about how you can grow your business. This is a sure sign they’re trying to get to know you and your business better. As they learn about your goals, fears, and strengths, your banker can go to work as your advocate.

A good advocate truly understands what you’re trying to accomplish and wants to see you succeed. They’ll keep an eye out for opportunities that align with your business goals and let you know when these opportunities are available.

Your business banker should be an advocate when looking for financial products as well. That means they’ll do what they can to help you get the best business banking products and rates. If you apply for a loan, for example, your banker supports you through the application process. As the bank looks at your application, your banker is there to fight for your business and make a case for you to get the best available terms.

In 2020, we saw this firsthand with the rollout of the Small Business Administration’s Paycheck Protection Program (PPP). Our business bankers worked hard to help customers across the state secure federal funding to help keep their businesses afloat.

A NETWORK EXPANDER

Working with a business banker can open doors to new clients, new connections and new opportunities. You'll have more chances to grow your professional network the more that you work with your banker.

Business bankers interact with business owners and managers of every type. There’s a good chance that your business banker knows a great accountant, lawyer, or other professional who can help your business. As they get to know your business, they can recommend you to their other clients.

Even if you’re not looking for professional services, your banker has access to the latest trends and information about the local economy and industry developments. They likely also have access to information on small business development in the community. No matter what you need for your business, your business banker is one of the best resources for recommendations or advice.

Benefits of Business Banking

A business banker is only part of the equation for running a successful business in Hawaii. You’ll need to use the right financial products to reach your business goals. A business bank account is a great way to manage your money and stay on track with your financial goals.

The biggest benefits of business banking include:

-

Organization: A business account keeps your financial records in one place and your business and personal finances separated. You’ll be able to accurately see how much money your business is making. Your business account easily lets you analyze your expenses to see where your business is spending most so you can make adjustments.

-

Tax Purposes: Having a separate account for your business makes tracking income and expenses easier at tax time. You can quickly look through your account records for deductions. If the IRS audits you, a business account helps prove you’re running a business.

-

Professionalism: Asking customers to write a check to your personal bank account can raise eyebrows and leave you looking unprofessional. Your business name on a bank account creates a professional image and instills confidence in your business.

-

Multiple Signers: Does your business have several employees who need to write or cash checks? A business bank account allows you to add authorized account users, such as your business partner or store manager, to the account.

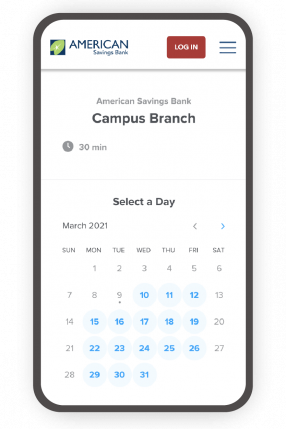

Ready to get some financial help with your business? Connect with one of our knowledgeable business bankers at ASB. Our business banking team has local experience in Hawaii and is ready to build a relationship with you and your business.