< Back Helpful Articles

How to Deal with the Financial Impacts of a Job Loss or Pay Cut

By

ASB

January 11, 2021 |

5 min

read

Personal

Unemployment is at an all-time high due to economic impacts of the COVID-19 pandemic. In August 2020, Hawaii had the country’s highest “insured unemployment rate,” according to the U.S. Department of Labor.

If you are dealing with a job furlough, loss or pay cut, know that you’re not alone and that there are resources to help. Here are a few of our recommended tips to help you protect and maintain your financial wellbeing during a loss of income.

DOUBLE-CHECK YOUR FINAL PAYCHECK

Take a look at your employee handbook or talk with your human resources department to find out how your company handles final paychecks. You may be owed more than the money you earned from your salary or an hourly wage. Some employers pay out unused vacation or sick days on the final paycheck. You may also be eligible for a severance package, which could help you cover expenses while finding a new job.

REDO YOUR MONTHLY BUDGET

A sudden loss of income can have serious consequences for your monthly budget. Review your budget as soon as you find out you’re being let go, furloughed or taking a pay cut. You may need to adjust your savings and expenses to meet your new financial situation.

The first step is to look for ways you can reduce existing expenses. Cut back on areas that are not an absolute necessity, such as monthly or annual subscriptions and nonessential items such as shopping or entertainment. You can also consider lowering necessary expenses such as rent and car payments, by finding a roommate or working with the company that provides financing. If you have an emergency savings or rainy day fund, determine if you need to start accessing it to cover expenses – after all, this is what it’s designed to do.

APPLY FOR UNEMPLOYMENT INSURANCE

Look into the government programs available to help those who are out of work. The most common form of government assistance is unemployment insurance, which helps to cover your expenses through weekly pay. During the COVID-19 pandemic, some programs were created to further support the unemployed. The CARES Act of 2020 made it possible for some workers to receive unemployment benefits after a pay cut or reduction of hours.

CONSIDER OTHER OPPORTUNITIES

Losing your job or getting a pay cut is challenging, but perhaps you can see it as an opportunity to pursue a career you’ve always dreamed of. Maybe you’ve always wondered about starting your own business or going back to school. You could explore a career change or look into job opportunities in a new industry. Talk about your dreams with your personal and professional network. You might gain some helpful advice for your next steps.

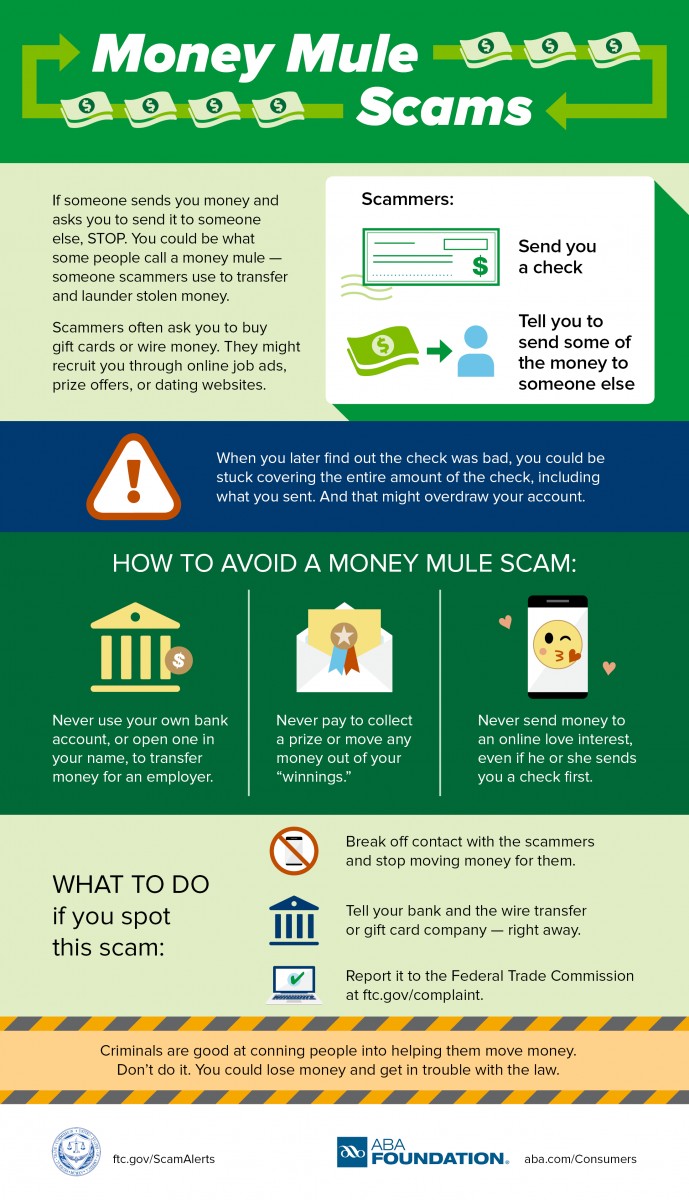

WEIGH YOUR CREDIT OPTIONS

Avoid taking on debt after losing your job, being furloughed or taking a pay cut. If you decide using credit is your best option to cover expenses, carefully consider all of your options and do your due diligence. If you’re approved for a credit card with a low introductory rate, for example, you could use it to pay for necessities. As long as you pay the minimum each month and the full balance before the introductory offer ends, you could save yourself hefty fees or interest charges.

If you are a homeowner, another option available to you may be to open a home equity line of credit (HELOC). A HELOC takes into consideration the value of your home for a credit line. You can draw money from your HELOC for expenses anytime during the draw period. You also only pay interest on the money you borrow. If you don’t need all of it, you can leave it in the account and avoid paying interest on the money you don’t use.

SKIP LARGE PURCHASES AND CUT SPENDING

Any major purchases you were planning to make (such as a new car, down payment on a house or large kitchen appliances) may need to wait until your financial situation is more stable. Other expenses to avoid include moving to a more expensive rental home or signing up for memberships, such as gyms or clothing services. Even smaller purchases should be avoided unless necessary.

CHECK YOUR INSURANCE COVERAGE

Losing your job doesn’t just mean you’re losing income. For many, health and life insurance are tied to their employer. If you get health insurance through work, you’ll need to look at your coverage options after being laid off. You can usually pay for COBRA coverage, which is a law that allows you to purchase your current health plan out of pocket. However, COBRA coverage has a limited timeframe and is often expensive.

Other options include shopping for a short-term health plan or browsing the marketplace for an individual plan. Losing your job usually counts as a qualifying life event, which means you can sign up for coverage outside of open enrollment periods.

EXPLORE HARDSHIP PROGRAMS

Cutting expenses, reworking your budget, and applying for new opportunities may still leave you without enough money to cover your bills in the short term. If financial hardship makes it impossible to cover your expenses, explore hardship programs that may be available to you. Hawaii residents can call Aloha United Way’s hotline at 2-1-1 at any time to receive assistance. You may qualify for financial assistance or hardship programs that allow you to temporarily pause loan payments or defer costs to a future date.

Losing your job is never easy, and it’s especially overwhelming during a pandemic. Following these steps can help you to manage your finances as you prepare for the future.

Need help? Contact one of our knowledgeable bankers to learn more about how we can assist you.

(Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion that it is appropriate for readers. The information that is contained in this material is general nature. Readers should seek professional advice for their respective situations.)